It’s all about Impact

28.10.2019Ville Eromäki

This headline has been the key message at the business events I’ve participated in during the last two months. The Shift Business Festival and Sijoittaja 2019- fair were good examples of this.

The Shift Business Festival connected investors, entrepreneurs and other guests around the world at the beautiful Ruissalo shipyard in Turku during the last week of August. The weather rewarded the visitors with sunshine and a good atmosphere. Many visitors agreed it was the best Shift event to date.

The festival started already on Thursday 28th Augusta with a side event Å Pitch where Mika Pyykkö from SITRA held an interesting speech about impact investing and how SITRA is making the impact through their SIB:s (Social Impact Bonds). But what do they mean with SIB, what is it about?

Social Impact Bond (SIB)

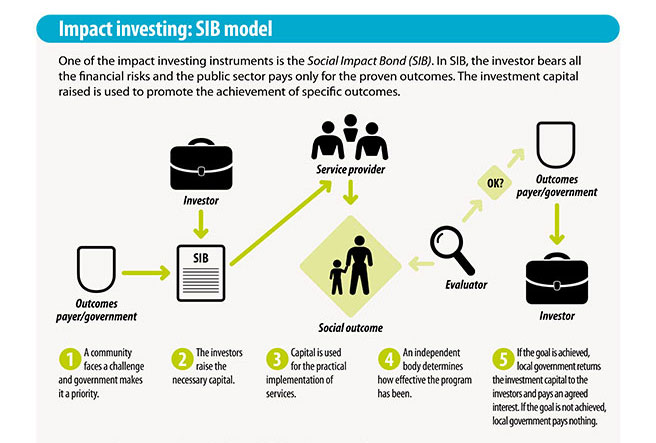

There are many instruments for impact investing and maybe the easiest to measure is the SIB model that SITRA uses. Even if the name reflects to a bond instrument, the SIB is really more like a fund instrument (contracts of different projects) that connects the money from SITRA, institutional and private investors with the service providers.

In the SIB model institutional and private investors invest in projects that promote well-being. The return on the investments depends on how well the projects succeed with the concrete, measurable positive impact targets that they are tied to. If the SIB-contract reaches its targets, investors receive the desired return and the society the pre-measured impact in a sense of wellbeing.

According to SITRA, each year, central government and local authorities in Finland make procurements valued at approximately 35 billion euros, so achieving an impact also implies more efficient use of billions of euros of tax revenue.

Taaleri as the frontrunner

Besides SITRA, maybe the most visible privately-owned firm with an impact message in the financial markets is Taaleri Plc. Also, as a main speaker at the Sijoittaja 2019 fair, Taaleri has been the frontrunner with impact investing since 2010 when their first wind energy fund was presented to the public.

Today Taaleri’s assets under management of wind and solar energy funds reaches a level of almost one billion euros and with these funds 1.2 million tons of carbon dioxide emissions have been saved from polluting the environment. The amount corresponds to the yearly emissions of almost 120,000 Finnish people. This, if some, is a pretty measurable positive impact! Besides the impact, Taaleri’s wind and solar energy funds have offered approximately 15 % return in average to the investors. Impact investing doesn’t have to be some charity investments as these numbers show. (Arvopaperi, 2019)

Thankfully also the other players in the financial market are wakening up. One good example is Osuuspankki that recently launched their Global Impact Fund where OP and Finnfund co-operate and promote the measurable well-being in accordance with the United Nations 17 sustainable goals.

It’s about ecological handprint, not just a footprint!

There are a lot of funds that boast a responsible investment strategy, but at least to my knowledge, usually these kinds of funds mainly exclude bad companies that are not suitable for responsible investments without really creating any new positive impact. It should be more about impact, not just investing responsibly.

To have a positive measurable impact is also the agenda we want to achieve with Aboa Advest. Since 2015, we, as a small Finnish family office, have wanted to transfer some measurable good into the society and environment, while aiming at a financial return over time. We take a rather long-term view with our investments in startups and growth companies.

It’s not too late for the others to join. In order to offer the life we have to our grandchildren and to be able to enjoy the weather we had at The Shift Business Festival, the world needs more significant investments with an impact from all the actors in the financial markets, not just from the small ones.

With impactful regards,

Ville Eromäki / Partner at Aboa Advest Oy