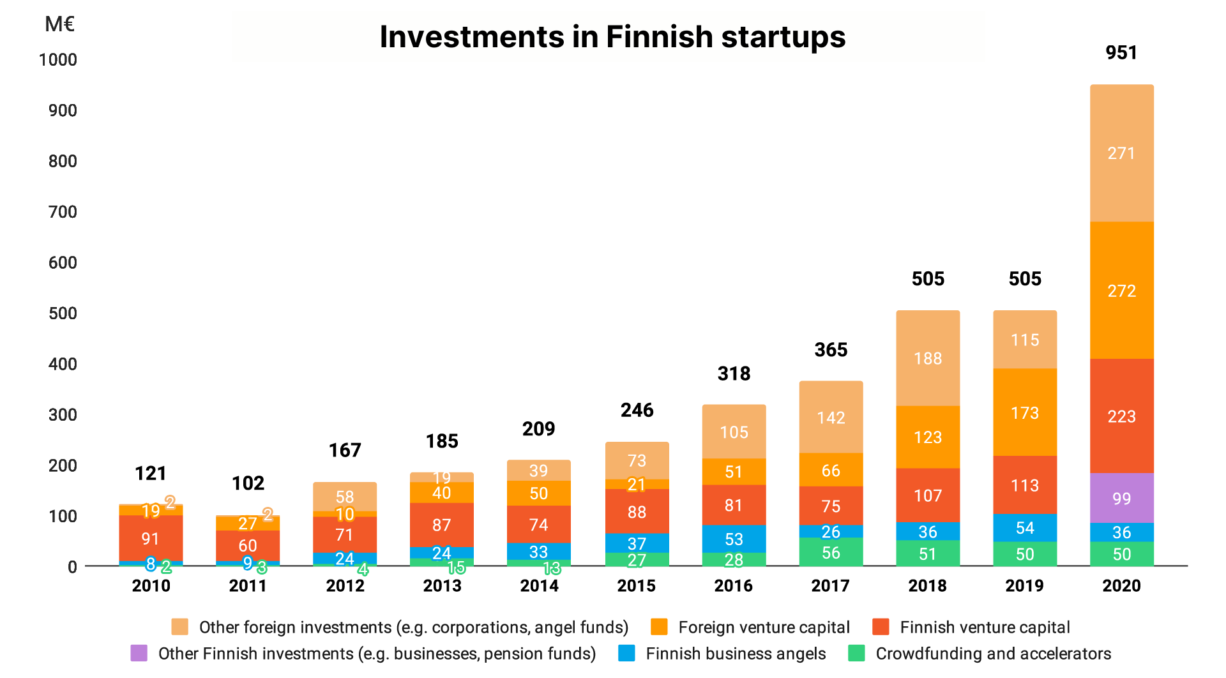

Domestic startups have raised a record amount of growth funding. The half-billion mark, which was reached in the two prior years, was already a record, but now the total has almost doubled: €951 million in funding was raised last year.

Of the total €951 million invested, the largest investor group was the venture capital investors, who invested €495 million into Finnish startups. Business angels invested a total of €36 million. The amount of capital raised by crowdfunding has stabilized at around €50 million. Other investors, such as larger companies and pension funds, invested a total of €370 million into Finnish startups. Foreign investments accounted for 57% of the total, totaling €543 million.

HUGE GROWTH IN VENTURE CAPITAL INVESTMENTS

In 2020, Finnish startups received a record amount of venture capital investments totaling €495 million. The total amount increased by more than €200 million from the previous year. The most significant growth was seen in Finnish investors’ investments in domestic startups. The investment amount doubled in a year, from €113 million to €223 million.

A new record was also seen in foreign venture capital investments: a total of €272 million was invested in Finnish startups. Foreign investments accounted for 55% of all venture capital investments.

“Finnish investors’ activity also increases the amount of international investments, as 83% of foreign venture capital investments made in Finland are made in cooperation with Finnish investors. 174 startups raised venture capital funding in 2020,” says Pia Santavirta, Managing Director of the Finnish Venture Capital Association.

“Due to the successful cooperation between entrepreneurs and investors, Finland is one of the fastest-growing European startup hubs. Expanding international networks will continue to be important so that an increasing amount of Finnish companies receive help so that they can develop into a globally significant growth company,” comments Janne Holmia, the new Chair of the Board at the Finnish Venture Capital Association and from Verdane.

BUSINESS ANGELS FOCUSED ON FOLLOW-ON FUNDING ROUNDS – A RECORD AMOUNT OF SUCCESSFUL EXITS

Business angels, private individuals who invest their own wealth into startups, invested a total of €36 million in 321 startups in 2020. The total decreased from last year’s record number €54 million, when many exceptionally large investments were made.

The main focus in investments shifted from new investments to follow-on funding rounds: as many as 79% of the startups that received investments were follow-on funding rounds, compared to 44% in 2019. “This reflects the message we heard from our members over the year, that in the midst of the pandemic, the main focus has been on helping portfolio companies over this exceptional period, and there has been less time to spend in finding new investments”, says Amel Gaily, Managing Director of the Finnish Business Angels Network.

“Despite the exceptional year, private investors made significant investments and activity, especially with acquisitions, filled many angels’ calendars. On the exit side, long-term activities, the maturing of the field, and activity of other early-stage investors are starting to show”, comments Reima Linnanvirta, Chair of the Board at the Finnish Business Angels Network.

Amongst angel investments, records were made in 2020 in exits made by investors: a total of 171 exits took place, up 68% from 2019. Of the exits, 13% were highly profitable, yielding a return of ten or more, and 6% yielded a return of five to ten. Despite the challenging year, the number of loss-making exits remained at the level of previous years, standing at 37% in 2020.

OTHER DOMESTIC INVESTORS AS A NEW TREND

For the first time, the statistics also show other domestic investors as a new group of investors. This category includes larger domestic companies and pension funds that made close to €100 million in direct investments in startups in 2020.

In addition, the amount invested by other foreign investors has more than doubled to €271 million. The largest single investment was a €195 million funding round raised by telephone manufacturer HMD, where the majority of the funding was raised from Google and Qualcomm.

“It’s great that in addition to venture capital investors and business angels, domestic companies have become more active as investors. The cooperation of local investors will enable more and more companies to grow into an international success story”, Pia Santavirta and Amel Gaily conclude.

ADDITIONAL INFORMATION:

Finnish Venture Capital Association

Managing Director Pia Santavirta

pia.santavirta@fvca.fi

+358 40 546 7749

Chairperson of the Board Janne Holmia

janne.holmia@verdane.com

+358 40 0843333

Finnish Business Angels Network

Managing Director Amel Gaily

amel.gaily@fiban.org

+358 50 3655 019

Chairperson of the Board Reima Linnanvirta

reima.linnanvirta@fiban.org

+358 50 538 1606

FVCA is the industry body and public policy advocate for the venture capital and private equity industry in Finland. As the voice of the Finnish VC and PE community and the entrepreneurs they fund, it is our role to demonstrate the positive impact of the industry on the Finnish economy. FVCA – Building growth.

Twitter | Facebook | Linkedin |Instagram | For Media | Subscribe to FVCA’s Newsletter

Finnish Business Angels Network (FiBAN) is a Finnish non-profit association of private investors on a mission to encourage private investments into early stage growth companies. The network is one of the largest and most active business angel networks in the world with over 670 approved members. www.fiban.org